Actuary

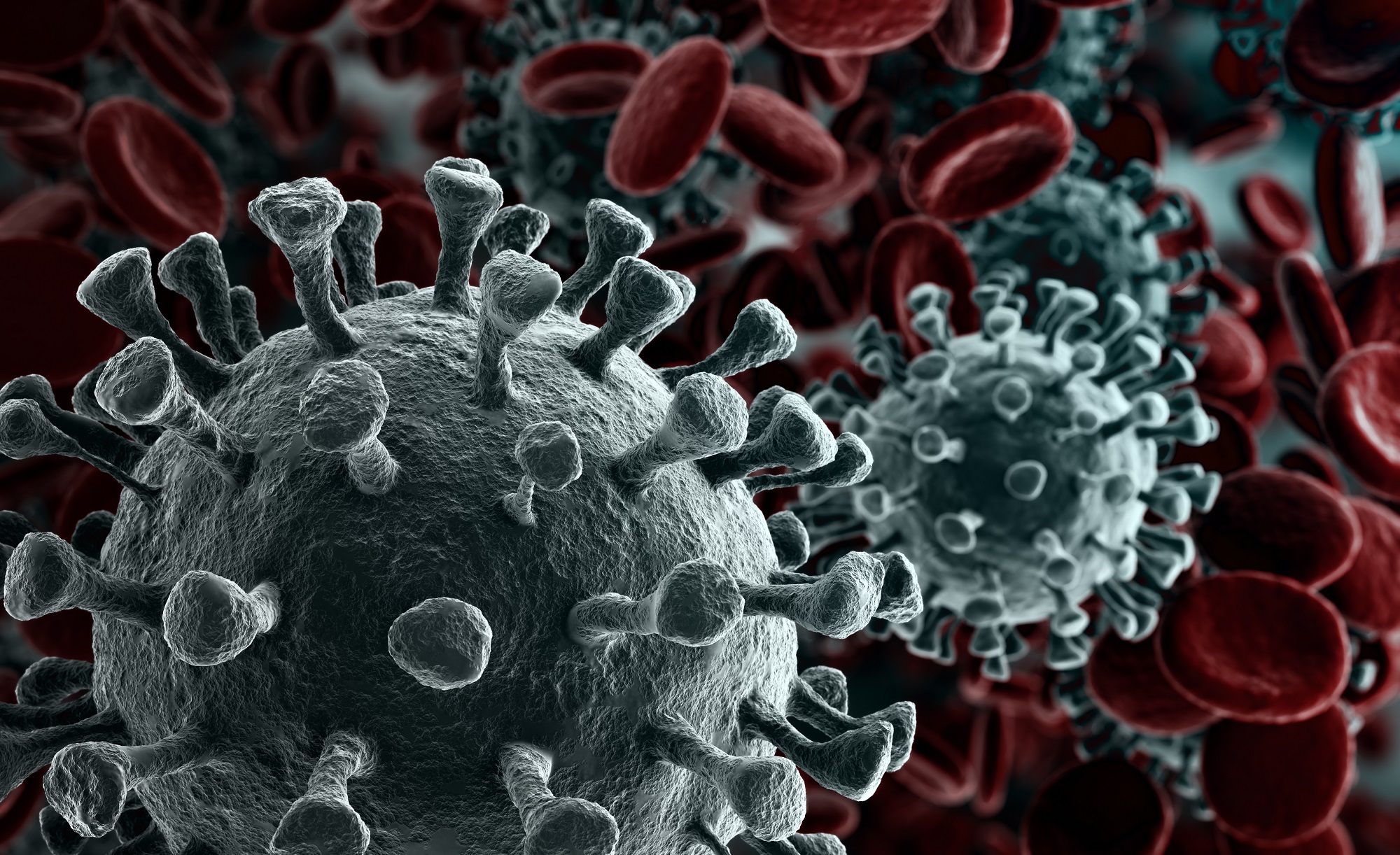

The coronavirus pandemic has created multiple challenges for our society and economy. Actuary Sara Ronayne argues that it is also a valuable learning opportunity, which we can harness to improve climate risk management practices going forwards.

The impact of COVID-19 has meant many insurers could face potential losses and uncertainty as to whether some of their policies are valid and if they need to pay out. In this blog we look at the range of issues they’re facing due to the pandemic.

Teams in GAD have just finished producing resource accounts for more than 20 public service pension schemes. We work with finance contacts at pension schemes, administrators and employing authorities across public service pension schemes across the UK.

Designing and hosting webinars is a new venture for us at the Government Actuary's Department (GAD). The coronavirus roadblock meant we had to find a new route to connect with our clients. Hear from 2 GAD actuaries about their experiences of life in the webinar lane...

In this blog we look one person's experience of owning Premium Bonds. These are otherwise known as perpetual bonds because they don't have an expiration date.

COVID-19 has given the financial sector a lot to think about including pension funds and their investment strategies, we look at how these have been impacted.

With the crisis of the COVID-19 pandemic causing huge pressures on the economy and much of the financial sector, we look at how pension schemes face unique challenges in this uncertain time.

Our society is ageing. Previous assumptions about costs and risks need revising. In this blog we ask how should we, as a society, fund future pensions and care for elderly people?

Life under lockdown has led to different experiences for different people, not least of which can be the role of educator. One of GAD’s actuaries reflects on his hitherto unknown skills where he combines the role of actuary with that of home schooling his children.

Have you ever looked at the yield curves from our market insights and wondered what they tell you? This blog explores what they might be telling you if the yield curve is 'inverted'.