The effects of COVID-19 are being felt by everyone worldwide with reduced travel, financial strain and uncertainty for the future. COVID has given the financial sector a lot to think about including pension funds and their investment strategies. In this blog we will look at ‘traditional’ Defined Contribution (DC) investment strategies and then explore how each aspect has been affected by the coronavirus pandemic.

Investment strategy

DC pension schemes invest contributions from the member and employer in the period before retirement, with the member using the proceeds to fund their retirement. The level of pension that a member receives is based on the level of contributions and the level of investment returns. According to the ONS Occupational Pension Schemes Survey, there were 9.9 million members of DC occupational pension schemes in 2018.

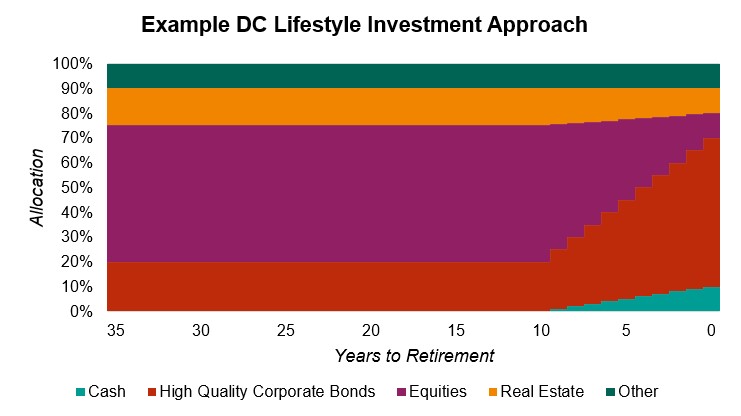

‘Lifecycle’ investing DC investment strategies tend to use the time left to retirement to determine the type of investment a member holds. The four main asset classes pension schemes will hold are: equities, bonds (government and corporate), cash, other (eg property). These will be held in different proportions in each pension pot depending on how long that individual has left to retirement age (as shown in the chart below). The first period of investment is the growth phase – this aims to grow the pension pot as much as possible by mostly investing in riskier assets such as equities. As the member gets closer to retirement, the pension pot will be invested in less risky assets such as government bonds and large corporate bonds.

Effects of COVID-19 on asset classes

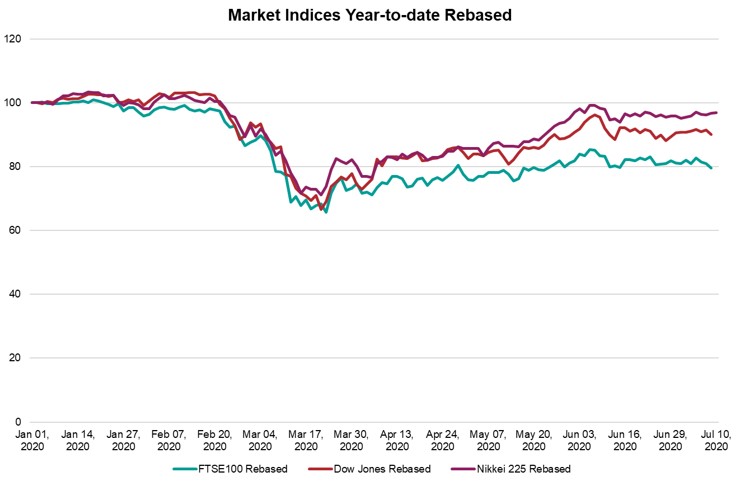

COVID-19 has caused a significant drop in most equity markets around the world with the FTSE 100 dropping 20.1% over the year to date (10 July 2020), Dow Jones dropping 11.0%, and Nikkei 225 dropping 3.9% over the same period (see chart).

Heavy losses incurred in February and March have seen some recovery since then, but volatility and uncertainty remain high – particularly as the level and timing of the recovery remains uncertain.

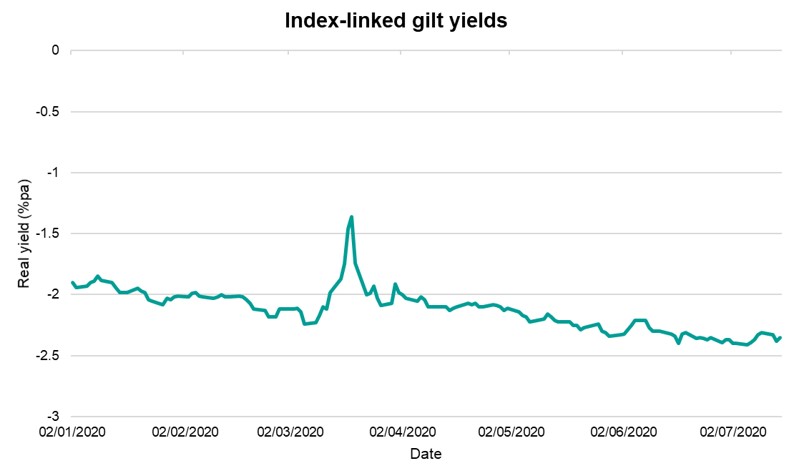

Government and corporate bonds are usually considered as safer investments – offering lower risk but delivering lower returns. Since the turn of the year, yields on government bonds have fallen (see chart) and hence values have risen, albeit with some volatility – particularly around the beginning of lockdown.

Generally speaking, corporate bond spreads (ie the additional yield relative to government bonds) have increased, meaning the relative price has fallen. This reflects the perceived increased risk associated with corporations as a result of the strain on businesses from COVID. The impact has varied for different companies – reflecting the different impact that COVID has had on different sectors.

The Bank of England base rate has hit an all-time low of 0.1% as part of the monetary policy stimulus in response to COVID-19. This means that holding cash bears little to no return.

Looking forward

Given the way in which the investment strategy varies over the lifetime of a DC pension pot, the impact of COVID will vary by member.

Members who are currently in the growth phase are likely to be most exposed to the fall in equity values as a result of larger exposures to riskier assets. While such reductions may be significant and concerning to members, it is also important not to lose sight of such falls being expected from time to time and that what matters more is the returns over the longer term – which allows time for returns to recover.

The situation is more complex for those closer to retirement age whose funds are starting to de-risk. On the one hand their exposure to the fall in equity markets is likely to be smaller and may be somewhat mitigated by bond investments. On the other hand, they have shorter investment horizons over which to recover from recent poor performance. Further any members holding cash, for example after taking advantage of the 25% tax free lump sum, are earning near-zero returns which might earn more invested in other assets. The fairly recent pensions freedoms might give members near retirement more flexibility and options than they would have had previously.

We have not experienced anything like the effects of the COVID pandemic before so there is great uncertainty about even the near future, but with careful planning and active engagement with our own pension pots, we should be able to keep them growing ready for retirement.