COVID-19 has had an undeniable impact on everything we’ve come to know as normal. This ranges from the way we interact on public transport, to government borrowing and spending.

The insurance industry has been no different. COVID-19 has been an especially bumpy ride for insurers with many facing potential losses and uncertainty as to whether some of their policies are valid and need to pay out. It has also brought about potential scope for new products to offer the market. In this blog I will outline the range of issues insurers are facing due to COVID-19.

Financial impact at a glance

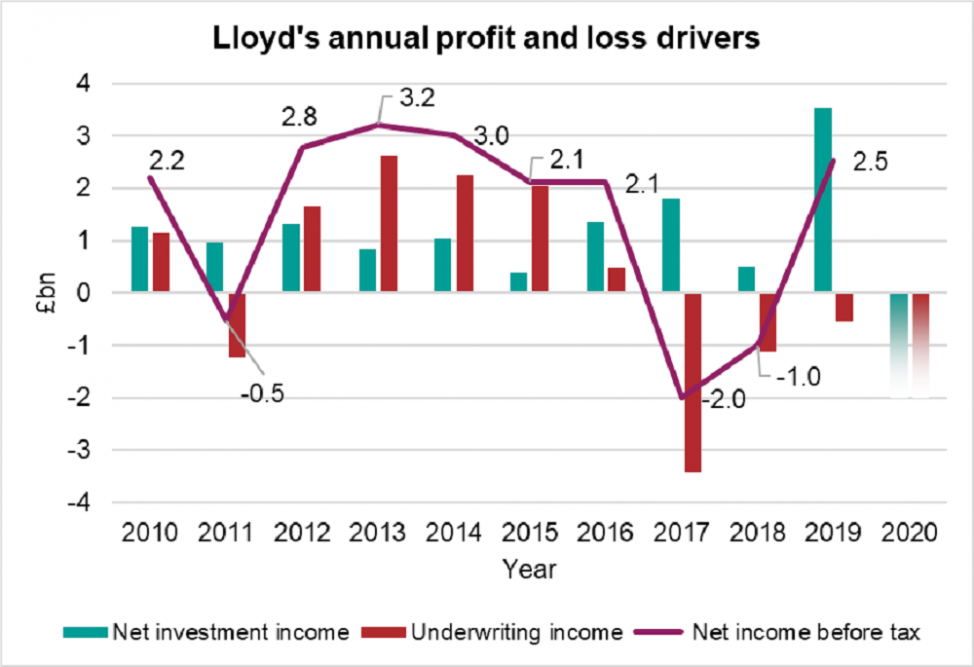

The chart (from S&P Global Market Intelligence) shows the key drivers of the annual profit and loss of Lloyd’s of London over the last 10 years. The drivers of that profit and loss are returns on investments (green bars) and underwriting profit (red bars); that’s premiums less claims and expenses.

We see here that Lloyd’s has generally seen profitable times over the last 10 years with the exceptions directly linked to large scale natural disasters in 2011 (New Zealand and Japan) and in 2017 (due to hurricanes Harvey, Irma and Maria).

The big question is what will this look like in 2020 due to COVID-19? It’s likely there will be a loss on both fronts as investment yields in interest rates fall while they may also be paying out a lot more claims.

Impacts on the policy lifecycle

COVID-19 is likely to have an impact on all stages of an insurer providing cover to policyholders shown in the diagram below. There are likely to be impacts at policy inception and winning new business right through to the end of the process of paying claims and sharing losses with reinsurers.

The impact of each stage is considered below.

New business and renewals

This is where policies are first being written and the things that insurers need to consider. There may be major changes in the types and levels of risks insurers are willing to accept. One example is in relation to life insurance where the insurer is exposed to mortality risk.

The different impact that COVID-19 has on this risk for different ages might lead to insurers reviewing who they provide cover for. Another example is the shift that has already been seen in the travel insurance sector with many insurers not providing cover for COVID-19 related cancellations.

With the losses projected for the industry in general, we may see rising prices going up in the future where insurers are trying to recoup these losses. On the flip side of this, insurers may think about paying out premium rebates to existing policyholders where the risk has significantly reduced.

The pricing response is likely to vary depending on the product. For example, motor insurance may see a reduction in prices due to there being less motor activity on the roads whereas products in higher risk classes (such as overseas travel) may see increases.

Insurers will need to consider which risks they are willing to accept. This will also apply to the outlook on demand and quality of data to determine pricing for the markets they want to remain in and potentially enter.

Investment

Once the premiums are in, insurers will consider how the cash proceeds can be invested in order to generate extra income. Many asset classes insurers are invested in have seen stresses in asset values. Insurers may review whether it is appropriate to consider changes to their investment approach in light of this.

However, most insurers are limited in the level of risks that they can take with their investment policy as they must maintain their solvency position to stay in line with regulation.

At the same time, with increased claims, there is a need for increased cashflow as payments need to be made. This may lead to them having to liquidate some assets, some of which may be at depressed values.

Reserving and capital

Insurers must hold reserves to meet claims that are due to be paid in future as well as a determined amount of capital in order to satisfy regulators that they can make a claim payment going forward into the future.

The biggest impact of COVID-19 on this front is likely to be significant impacts on the frequency and severity of claims. With the greater uncertainty in claims modelling, it will be important for insurers to ensure that they are holding sufficient capital to satisfy regulators that they are solvent and able to meet their obligations.

Regardless of the internal model which insurers use to calculate their solvency position, insurers will generally need to hold more cash despite this being a time when asset values have fallen.

Reserving and capital positions are an ongoing exercise and a lot of work and liaison will need to be done with regulators who may or may not be more lenient given it is a situation affecting the whole industry.

Claims management

Claims management staff, which consists of call centre operators and claims assessors will generally now be working from home due to COVID-19. This will impact the volume of claims as well as the speed at which they are settled.

This will affect immediate cashflows as well as projections of claims as there will be increased delays before claims being reported and claims being settled.

There are also going to be different types of claims which may need different skillsets to what would normally have been in place in a pre-COVID-19 market.

It is generally known that insurance fraud increases during periods of economic hardship and this is something insurers must be vigilant to in these times and factor them into their models.

Reinsurance

Insurers use reinsurance to protect their positions. COVID-19 brings questions of whether the cover taken out covers what was expected. There are also considerations as to whether these covers will remain available in the future.

Insurers are likely to review their internal models and it may be the case that due to the lower asset values, higher capital and new risks, they may need to change their approach when it comes to reinsurance.

Just like insurers, reinsurers are likely to alter their products and prices given the changing landscape of the industry.

What’s next for insurers?

All aspects of the policy lifecycle have been impacted by COVID-19. Insurers will need to be thorough in their planning to mitigate these effects in order to return to profitability as soon as possible.

While pandemic planning and modelling is something most insurers have been doing internally; it’ll be interesting to see who have got the planning right. This will help identify who are best placed to manoeuvre the industry in the state COVID-19 has left it in.

For further detail and expertise from GAD, see our Market data insights. The opinions in this blog post are not intended to provide specific advice. For our full disclaimer, please see the About this blog page.