The COVID-19 pandemic has caused major economic damage for countries across the globe and the UK economy has experienced a significant shock.

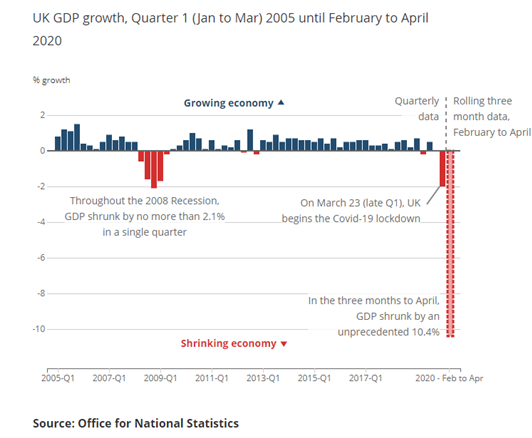

According to a report by the Organisation for Economic Co-operation and Development, Britain’s economy is on track to suffer the worst damage of any country in the developed world. Initial statistics show that the economy shrank by 10.4% in the 3 months to April following the first full month of the UK’s lockdown, as shown below. (Footnote no. 1)

Pension schemes in particular are faced with challenging circumstances, faced not only with risk, but also opportunity. For some, the crisis will have demonstrated resilience in their current asset liability modelling. For others it highlights gaps in their approach and exposes a need for more attention to be paid to the investment and risk management strategy.

One thing that is apparent is the uncertainty around the future economic outlook. The government response to the public health crisis will undoubtedly impact the economic factors considered in a buy-out and this impact may vary considerably between different approaches.

The volatility in the markets over the past few months has demonstrated this, and it may be sensible to assume considerable market volatility for some time to come.

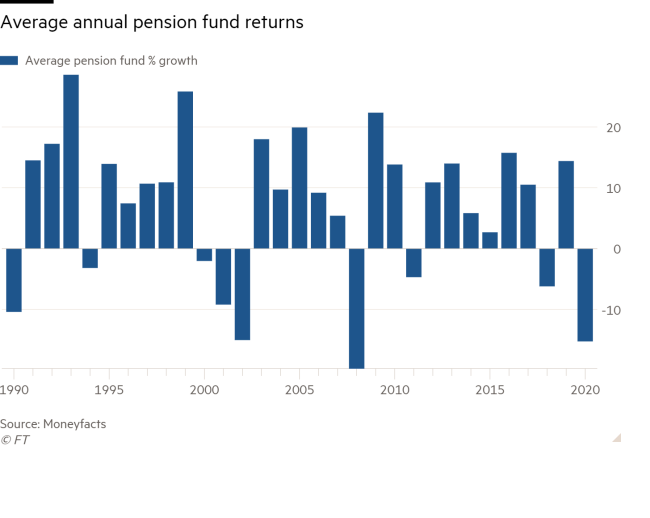

Pension funds fall

In the first quarter of the year, the average pension fund fell by 15%. (Footnote no. 2). Although, whether a particular fund is better or worse off is highly dependent on their investment strategy.

Those funds which are heavily invested in gilts may even have increased their funding position over this period. The best performing sectors were UK Gilts (7%), Global Fixed Interest (4%) and UK Index Linked Gilts (3.9%), demonstrating that lower risk assets were more resilient to market shocks.

Recent history has demonstrated that periods of market disruption may provide opportunities for well positioned schemes to engage in de-risking deals such as a 'buy-out'.

One of several de-risking methods, a buy-out is a way to transfer all their liabilities to an external insurance company. This will then provide security to members and take on the responsibility of paying out the pensions promised to members.

Once the buy-out is complete, all links with the former sponsor and trustee are severed and a contract from the new insurance company is issued to the scheme member. However, to do this a scheme must have the correct level of funding. This means that for those schemes hit hard by low asset returns and market volatility, this may not be an affordable option.

How has the demand for buy-outs changed?

Aon, a large British global professional services firm, tracks the buy-out funding position of around 200 UK pension schemes. (Footnote no. 3) . Its analysis shows that buy-out levels of funding have held up more strongly than might be expected and around a fifth of schemes have benefited from an improvement in their buy-out position.

These schemes tend to have low equity allocations and exhibit high levels of hedging. If pension schemes are well funded, then the schemes are often closer to being able to afford buy-out than they may have realised.

The main mitigating factor against the recent economy fall outs of COVID-19 is that the average pension scheme now holds a far higher percentage of bonds and hedging assets than in the 2008 crisis.

According to the Pension Protection Fund’s 2019 Purple Book, average bond allocations have risen from below 30% in 2007 to 63% in 2019. However, even allowing for this, asset returns are unlikely to be much above zero in aggregate.

In contrast, liability valuations could see increases of close to 15%. It is not hard to envisage some schemes seeing their funding levels fall by 10% or more, meaning buy-out becomes an even more distant option.

Has COVID-19 impacted the appetite among insurers?

Credit spreads, the excess yield available from corporate bonds over gilt or swap yields, widened sharply in March as investors reallocated funds from higher risk assets to safer ones. Insurer pricing for a buy-out will generally be improved by widening credit spreads, as this means that the credit assets that the insurer will use to back the liabilities will have lowered in price.

However, given the widespread nature of the crisis, credit spreads may have increased due to market concerns over potential future defaults. Therefore, the impact of wider credit spreads will not be fully reflected in the impact on the buy-out price as insurers might make a larger allowance for default risk.

Insurers are required to hold a certain amount of capital under Solvency II regulations. The amount required to be held will be increased by the low interest rates and this will in turn increase the buy-out price. This will be more acute for longer duration business – so especially where schemes cover deferred members.

However, Aon’s research shows that the insurers in this market are starting with strong balance sheets and capital positions in excess of statutory requirements with interest rate and inflation risks generally closely hedged.

For most insurers, a net improvement in price is expected when compared to a gilts benchmark, but this will vary across insurers dependent on their individual investment strategy and will differ across schemes depending on the duration of the liability being insured. Reports suggest that there is still a strong appetite for buy-out transactions among insurers following a record high number of transactions taking place in 2019. (Footnote no. 4)

New challenges as a result of COVID-19

There are also new challenges introduced by the pandemic. The opportunities are the best for those parties with the ability to be flexible. Pricing windows and the time prices are locked in for are shorter than normal. With high uncertainty in the markets, there’s a trade-off to be had between execution time-scales and the price.

There are also unprecedented challenges around the capacity for transfers, the industry is generally set up for remote working, but it is likely that both sides may experience some temporary fall in available workforce.

The pricing of a buy-out is highly complex and is also heavily dependent on the position of each scheme and insurer. However, there seems to be a continuing appetite among insurers and schemes for transactions to go ahead. In such a volatile market there will be large variation in the impact experienced by different pension schemes.

Those which are significantly de-risked with interest rate and inflation hedging might find themselves with an improved buy-out funding position due to increasing credit spreads starting to impact quotes from insurers. As with any source of market volatility, there will be opportunity for schemes who are well positioned and well prepared to achieve an attractive price.

Recent Comments