Inflation is a key indicator of the health of an economy but with no single approach to measuring inflation, there is often debate about which methodology is most appropriate. Additionally, decisions over how to measure inflation do have real world consequences.

This blog looks at how inflation was affected during the pandemic and the outcome of a consultation to reform the UK’s longest standing measure of inflation, the Retail Price Index (RPI).

The 3 most common measures used in the UK are, RPI, Consumer Prices Index (CPI) and Consumer Prices Index with Housing (CPIH). A previous GAD explanatory note provides more detail. Essentially, price inflation refers to the increase in the price of goods and services over time and the measures differ by looking at:

- which goods and services are included in the measure (for example, RPI and CPIH include housing costs)

- the formula used to combine different prices into a single measure

Inflation in a pandemic

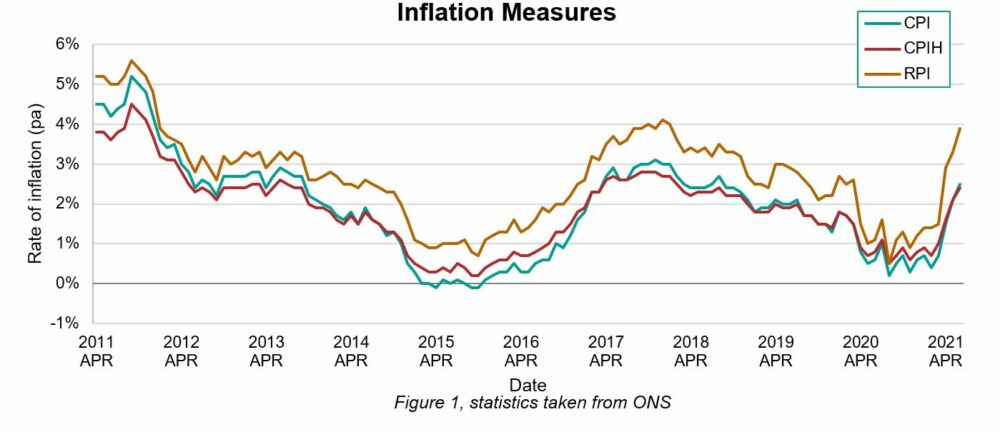

Figure 1 shows 3 different inflation measures, RPI is consistently higher than both CPI and CPIH but despite expectations that CPIH will be higher than CPI on average, we can see from the past 10 years that this has not consistently been the case.

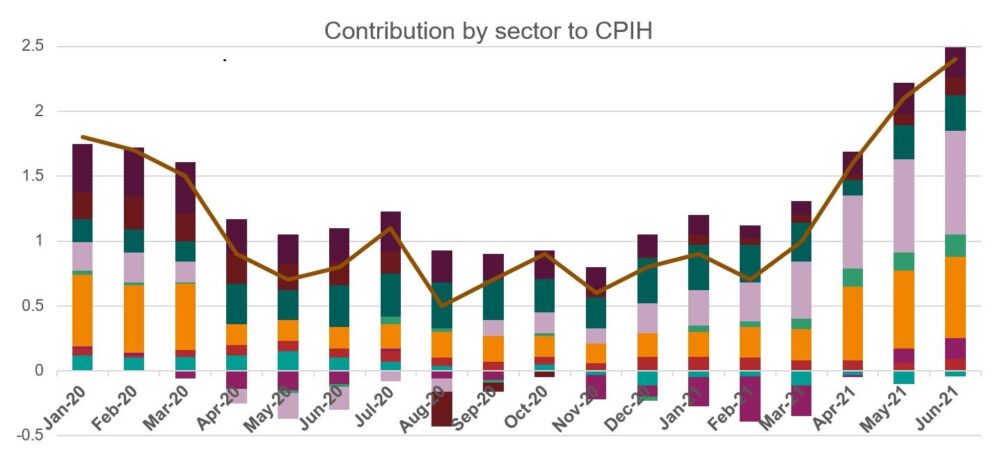

Figure 1 also highlights that the pandemic caused a sharp drop in all 3 measures of inflation from March 2020 to March 2021. This fall is largely driven by impact on housing, restaurants, and hotels, as well as transport industries (shown below in figure 2). As these industries were hit, prices within the sector fell (notably in August for hotels and restaurants as they tempt customers back), causing the sectors to contribute less to the overall CPIH figure.

These industries suffered during the lockdown as they were heavily impacted by the lockdown measures, however the recreation and culture industry was resilient across the sector. While the number of holidays and trips out went down, other areas of recreation such as gardening and audiovisual devices saw an increase in prices as consumers shifted their forms of recreation.

Following targeted policies and the easing of lockdown measures, the housing, restaurants and hotels, and transport sectors rapidly started to increase in price as consumer demand rose. It’s also important to recognise that other factors will be impacting on the inflation measure, such as the exit from the EU.

The RPI consultation conclusion

RPI has been dropped as an official national statistic, due to the shortcomings of the current approach. However, due to largely historic reasons, it is still used across government. In 2019, changes were proposed to RPI and in January 2020, GAD released a Technical Bulletin describing the possible changes and their potential impact. A conclusion was reached in November 2020, where following a consultation, HM Treasury announced that it would reform RPI in line with CPIH approach by February 2030.

This news has been met with mixed reactions as there are perceived winners and losers resulting from this decision, as CPIH is expected to be lower than RPI on average. To illustrate this point, the Association of British Insurers estimated the impact of the change could be around £96 billion. It will largely impact savers and companies that invest in government debt linked to inflation (known as index-linked gilts) and those with defined benefit pensions with increases linked to RPI.

The Pensions Policy Institute estimates that the impact on pension holders will be felt the greatest for those with final-salary pensions. It also estimated the average reduction in lifetime income from an individual’s RPI-linked pension post-retirement could be 5% for a woman and 4% for a man (based on a 65 year old in 2020). Women will generally experience a greater lifetime reduction in overall pension benefit, as they live longer than men, on average.

With this cost to pensioners and investors, comes opposition to the change. Members of different pensions funds from Marks and Spencer, Ford and BT have challenged the alignment to CPIH. They claim that government did not properly consider the effect aligning to CPIH would have on those whose pensions were linked to RPI. This judicial review is still ongoing.

As with any change, there is a flip side, for example those with student loans may find the interest on their loans lower than would otherwise be the case.

Disclaimer

The opinions in this blog post are not intended to provide specific advice. For our full disclaimer, please see the About this blog page.

10 comments

Comment by PETER REYNOLDS posted on

Clear and concise. Quite thought provoking and, for me at least, very helpful.

Comment by C posted on

Can we get access to the underlying historical data?

Comment by lisabrowne posted on

The data is all publicly available. The various datasets can be found on this site: - https://www.ons.gov.uk/economy/inflationandpriceindices

Comment by Ted Shaw posted on

RPI is a solely arithmetic calculation of inflation and in the year 2022 it should not be used by any company as a calculation of inflation. I perfectly understand the situation for Government and as for DB Final Salary pensioners, of which I am one, they should just bite the bullet like their children, grandchildren and great children are having to do with taxes.

Ted Shaw

Comment by Albert E posted on

Ted's previous comment shows a total lack of understanding, or some kind of affiliation to the .gov.

To 'just bite the bullet' is such a careless statement to put out there. No I don't think I will just bite the bullet Ted.

The RPI Index is calculated by an arithmetic mean not by sole arithmetic, it measures the changes in prices of individual goods and services which is done by comparing them to their levels in the previous year. These are then calculated together and using the weighting for the current year [against the weighting for the previous year] this produces an overall average price change, giving you the RPI.

Is it perfect, not at all, but neither is any of the alternatives.

The reason RPI isn't liked is because it always gives a slightly higher percentage point of inflation against CPI, which is calculated by way of geometric mean.

As most people already know, the Government uses both [to their advantage obviously].

They use CPI calculations for the state pension rises, allowances etc [basically anything they give to you]

They use RPI calculations for taxes, duty etc [basically anything they take from you].

Who would of thought it would end up that way around eh.

Comment by Ted Shaw posted on

Thank you for your comments although really a bit harsh.

I am not affiliated to anyone on .gov and just believe that CPI H is a much more meaningful measure of inflation as it also considers the increase in housing costs ( not buying and selling).

The stats that are distributed regarding RPI take time and so the Govt. Dept. that provides them is using tax payers money to allow the time to provide information to the Corporate Companies and to the General Public regarding a calculation that was discredited in 2013 by the ONS. I am not politically motivated in giving these comments, just on the side of accurate increased charging by Corporates such as BT, SKY and Vodafone.

Comment by Dr Donal Walsh posted on

Ted, (i) As you already know, neither CPIH nor CPI include mortgage payments or house prices. And it is a moot point whether the CPIH use of rental costs and changes to those costs, as an indicator of the relevant changes to housing costs is a reliable/valid reflection of the realities experienced by either all or specific groups of individuals and organisations, particularly when, as occurred at the end of 2022, mortgage costs rose suddenly and relatively steeply at the same time.

(ii) As you also know, at any given time 'inflation' can have significantly different impacts on individuals, organisations and institutions whether classified by SEG, SIC, Public/Private sectors etc. such that it is not possible for a single measure of inflation to be universally apt. Which index might be 'apt' would depend on the purpose/s for which the relevant index is to be used and the extent to which that index has perceived legitimacy amongst those parties with a stake in the outcomes that might be brought about, whether those parties be individuals, organisations, institutions, government bodies, etc. CPI, CPIH, RPI each have their uses, advantages and disadvantages. The same comment could be made about any index, whether primary or secondary, and also about any type of index, whether simple or composite.

Comment by LP posted on

Its not just DB pension scheme members who will be affected by the changes in calculating RPI, but also those with annuities which have increases linked to RPI. The government consultation completely ignores those who have purchased these annuities who may have made a different decision if only they had known a change like this could be made. It does seem the change might result in a windfall to annuity providers (depending on how they back their liabilities), with no obligation on them between now and 2030 or whenever the change is introduced to warn prospective purchasers of the change. Where does treating customers fairly come into all this?

Comment by Paul chapman posted on

The change to cpi was introduced by George Osborne essentially as a way of reducing public expenditure on welfare benefits and pensions. As a previous commentator notes the government has not carried the logic forward to using cpi for other areas. I’m not sure when or if MPs pensions have been moved to cpi for example and student loans continue to increase by rpi. One wonders if the “superior “ cpi would have been introduced if it produced a long term higher increase than rpi. Oddly the rpi always reflected council taxes not included in cpi. This excludes a cost everyone pretty much can’t avoid unlike other goods and services.

Comment by Robert Whyte posted on

The article is very informative and explains inflation measures well. However, we cannot keep on using 'across the board' percentages as a measure of inflation and pay rises. We need to get back to pounds, shillings and pence!

If a 150% pay rise does not give you the same amount in pounds, shillings and pence as the rate of inflation then you are doomed.

A low paid worker hopes their 5% pay rise meets the pounds, shillings and pence extra that a 2% inflation rate causes.

A highly paid workers knows that their 5% pay rise will give them multiple times the amount that a 2% pay rises causes.

As the higher paid are in charge the gap will always get larger and those on lower wages will always struggle.

An across the board pay rise where everyone gets the same amount and it is above the inflation rate is the ONLY way to beat a recession!