Many hedge funds are designed to withstand market volatility, or even exploit it. The COVID-19 pandemic has proved a difficult challenge for the industry that not all its players have managed to live up to.

What are hedge funds?

A hedge fund is a type of alternative investment that can trade a wide range of financial instruments including shares, bonds, currencies, commodities, and derivatives. The objective is to generate high returns while reducing risk and fund managers usually adopt complex strategies to try to achieve this.

While ‘hedge’ means to manage risk, a hedge fund is by no means risk-free and not necessarily low risk either. Across the sector, fund objectives and underlying investment strategies can vary greatly, and so too can the investment returns, volatility, and risks.

The big short

A common hedge fund strategy involves ‘short selling’ where the fund takes a ‘short’ position so that it makes a profit if a particular share price falls.

This contrasts with traditional investment where the investor takes a ‘long’ position, i.e. buys a share and makes a profit when that share price increases. Therefore, hedge funds often seek opportunities to make gains when specific companies or sectors perform badly.

For an example of how short selling works, let’s say you anticipate that a company’s share price will drop. You could borrow one share from a willing lender worth, say, £10 and sell it elsewhere for £10 cash. Then you can wait for the price to drop, buy it again for, say, £8 and repay the borrowed share back to the lender. Now you’ve made £2 profit (at the expense of the lender).

Hedge funds will often buy shares they think are undervalued and will perform well while short selling shares they believe are overvalued. This provides some protection from the risk that the whole market falls.

However, this carries the risk that a share price increases, and the fund has to buy back shares expensively. There is no limit to the potential losses here which can be enough to cause funds to collapse.

Just this week US hedge funds that short sold shares for video game retailer GameStop saw huge losses after the price jumped over 300%. This unexpected surge was caused by a group of investors from Reddit forum r/wallstreetbets with the specific goal of punishing Wall Street for their pessimism.

Who invests in hedge funds?

Hedge funds are generally more sophisticated and have higher fees than other investment vehicles and so have typically been restricted to wealthy individuals and institutional investors.

Many insurers and pension funds have some allocation to hedge funds, though these allocations have been decreasing in recent years due to poor performance.

European insurers overall have trimmed their hedge fund allocation down to 1.5%. Also, the UK’s largest pension fund, the Universities Superannuation Scheme, has announced its intention to halve its £1.8bn hedge fund holding out of its £68bn total assets.

How have hedge funds reacted to COVID-19?

When the pandemic hit at the start of 2020 some hedge funds sought to make gains from the stock market collapse. The airline sector, which suffered particularly badly, became a target for short sellers.

Short selling of UK-listed companies increased considerably in March – so much so that (as reported in The Independent), it led to a plea from the Bank of England governor Andrew Bailey for hedge fund managers to stop.

Hedge funds that were well-positioned in anticipation of the market shock made significant profits during this period. More generally, however, the sector suffered as investors pulled billions out of hedge funds amid the economic uncertainty and market volatility.

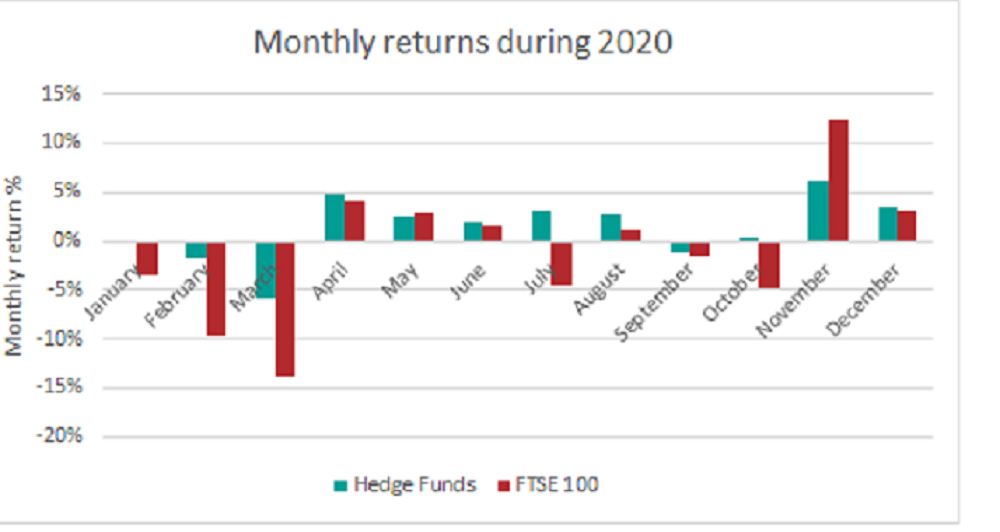

Returns were disappointing compared to other classes, losing an average of 3.5% in the first half of 2020 according to data group HFR. In the case of UK hedge fund managers Lansdowne Partners, returns were catastrophic. Their flagship fund, which had taken a long position on airlines (i.e. had bet on airline stocks to succeed), fell 23% in the first half of 2020 and subsequently closed.

As markets started to recover, so too did hedge funds. Across 2020 hedge funds on average saw a full-year return of 11.6%. Such a high performance was in stark contrast to the FTSE 100 which fell 14.3% over the year after being hit so badly in the spring.

Recently, funds have tried to exploit companies that have performed well due to COVID such as Zoom and HelloFresh which have flourished in the new era of remote working and learning.

Some hedge fund managers believe these companies are now overvalued and have begun to short sell these shares. This would have paid off when these shares fell sharply on the news of Pfizer and BioNTech’s successful vaccine trial in November.

A new way of doing business?

Hedge fund firms have faced a few drawbacks in adapting to remote working. One issue is that the industry has always been heavily dependent on face-to-face interactions for networking and building relationships.

This year, however, business has mostly been conducted virtually rather than at lunchtime meetings in London’s Mayfair district. Investors that are unable to do their due diligence in person might play it safe and stick with the bigger, more established fund managers, which may put smaller firms at a disadvantage.

According to this year’s KPMG/AIMA Annual Global Hedge Fund Survey the top concern among firms is diminished team building and a dilution of culture. And it seems many managers are looking forward to an eventual return to the office. No doubt they, like the rest of us, are looking forward to a return to normal life.

Disclaimer

For further detail and expertise from GAD, see our Market data insights. The opinions in this blog post are not intended to provide specific advice.