The Chancellor has announced that Britain will issue its first green government bond in 2021. The bonds will be issued as part of the COVID-19 stimulus package and will support the government's ‘Build Back Greener’ agenda.

Green bonds are ordinary bonds that are issued to fund investments with an environment, social, or governance (ESG) focus. As such, the funds raised from green can be used to create a cleaner environment and fund projects that protect the environment. This can include renewable energy infrastructure or clean energy projects.

Green bonds were primarily driven by multilateral development banks (such as the World Bank). They are now issued by both private institutions and public sector organisations including local and national governments.

Why invest in them?

Demand for green bonds in countries where they are already issued has been high. Some reasons investors would buy these bonds are:

- incorporating ESG factors and sustainability into their investment approach

- diversifying their investments to reduce the overall risk of their investments

- expectations that demand for green bonds will be sustained (relative to regular bonds)

- potential for a capital appreciation

However, there are some potential drawbacks as well:

- How do you measure the green credentials of an investment and what counts as environmentally friendly?

- Low supply and high demand mean they are traded at a premium so are costly compared to normal bonds.

Overall however, green bonds seem to be growing as does the investment in them as I explain in the next section.

The growth of the green bond market

As stated, the demand for green bonds has been growing more so in the last few years. More governments have started to offer them as well for various reasons. For example, the sovereign green bonds issued so far have been hugely oversubscribed.

The latest figures show that more than EUR 33 billion of subscriptions have been attracted for only EUR 6 billion of 20-year debt. As expected, issuance has increased to supply this demand, and due to the current pandemic COVID-19 the issuance has started to go higher.

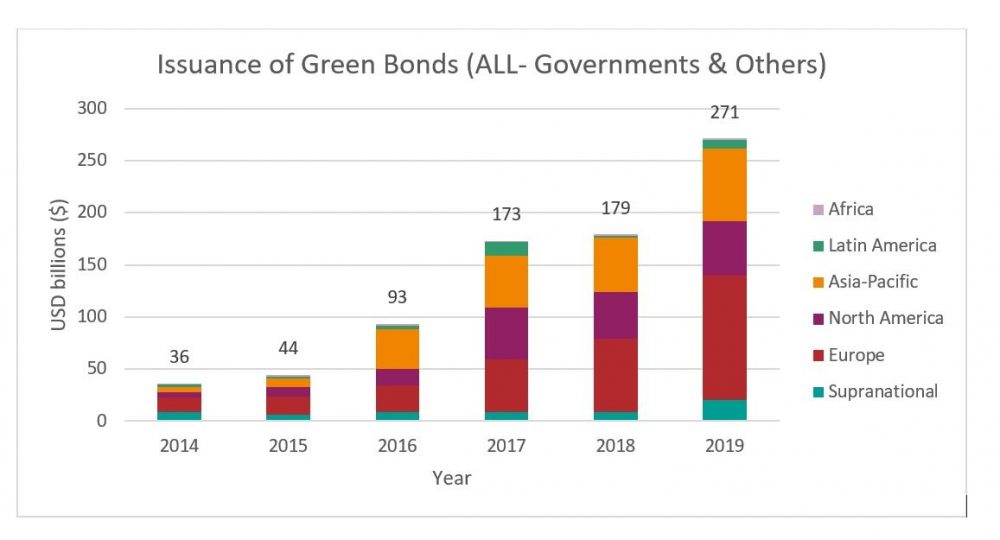

We can see that the issuance has been increasing massively especially in Europe (from around USD 15 billion in 2014 to around USD 130 billion in 2019) as more and more countries have started issuing green bonds. For instance, Germany launched a EUR 6 billion green bond in September becoming the newest issuer in Europe.

The UK, COVID-19 and the look ahead

Issuance has been increasing and this seems to have been accelerated by the coronavirus pandemic. In the second quarter of 2020, the issuance globally of green, social and sustainability bonds shot up to a record 65% higher than the first quarter (USD 99.9 billion).

As noted above, the Chancellor Rishi Sunak announced the UK will sell its first green bond next year. This will be used to fund projects to tackle climate change and meet the UK’s 2050 net zero target. This initiative is also expected to create green jobs and contribute towards the economic stimulus in response to COVID-19.

The government also said it would establish clear rules on what counts as ‘green’ investment, based on an EU framework with possible UK-specific adjustments.

This goes along with the Chancellor’s plan to mandate large companies to disclose their climate risks by 2025 which is an aim the UK wants to uphold to renew its position as the world’s pre-eminent financial centre.

With the UK joining other countries as an issuer of green bonds, the market looks set to continue to grow with green initiatives and regulatory support likely to continue to drive issuance.

Disclaimer

For further detail and expertise from GAD, see our Market data insights. The opinions in this blog post are not intended to provide specific advice. For our full disclaimer, please see the About this blog page.