It’s a new venture for us here at GAD – creating, designing and hosting webinars. The pandemic created a roadblock for us to reach our clients in the traditional face-to-face way. It’s meant we’ve taken a detour but with the same aim, to connect with our clients through webinars instead.

As an organisation we’ve really embraced webinars as a way of reaching different audiences. These have ranged from small groups of clients who are interested in specific issues, to speaking to around 1,000 attendees from the Civil Service.

GAD actuary Jacqui Draper takes up the story…

In GAD’s ‘Making sense of COVID-19’ programme of webinars we tackled topics which included commercial insurance (and all that that involves), mortality impact on pension schemes (over 100 attendees) and finally the effects of the pandemic on climate change risk management where around 80 people took part. Not only that, the ‘Making sense of COVID-19’ programme ran alongside a separate series of webinars helping our public service pensions clients.

Sharing expertise

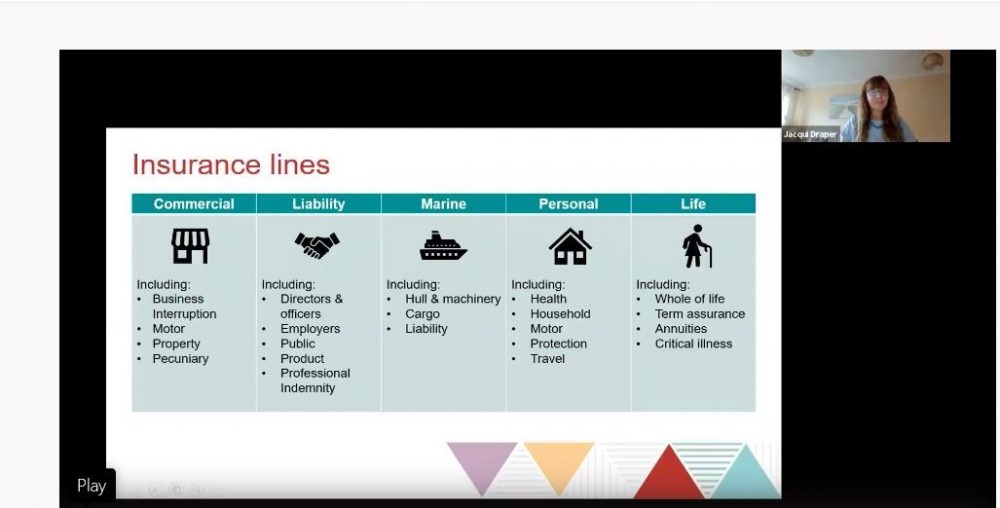

I was a co-presenter on the first webinar in this series in which we focused on commercial insurance and which attracted more than 80 attendees. It was a major opportunity for us as actuaries, as specialists, to be able to share further expertise with our clients and more widely.

Once we’d decided that there was a huge opportunity for us to share our insight into the impact of the pandemic on a range of issues, we set up the webinar programme in a few weeks.

Colleagues and I have previous experience in commercial insurance in the private sector and we’re now part of GAD’s insurance and investment team. We’re well placed to talk about how COVID-19 is affecting all kinds of insurance; the sort of policies that people buy on a regular basis. These include for example, business insurance as well as cover for houses, cars and of course the obvious one, travel insurance.

As you might expect the insurance industry has experienced what looks like the perfect storm of issues caused by the pandemic – not least has been the increased claims, demand shrinkage and falling asset values.

My co-presenters and I examined the policy lifecycle starting from new business and renewals and looking at investment, reserving and capital, claims management and reinsurance in turn. We looked too at the real-life impact of COVID-19 on insurance. The impacts mean events have been cancelled and film and TV productions were put on pause (although there is now a remedy for that).

We also examined the implications for cover that people may have taken out for property, business interruption, medical negligence, mortgage cover and travel to name just a few. The COVID-19 effects have been all encompassing and insurance experts are now working through these issues to see how to mitigate the effects.

Lessons learned

In the end, here’s what I learned from preparing and delivering my first webinar. First, as you can’t see your audience, you can’t gauge their reactions. So, on the plus side it was slightly less scary than I’d anticipated.

Overall it meant I had to think carefully about the level of detail on the slides, working out how the information was displayed, and remembering to pace my delivery to help keep people engaged.

Civil Service Live

Insurance was also a key aspect of the Civil Service Live presentation co-presented by Matt Gurden, Actuarial Director. He reflects on his experience as a presenter of a webinar attended by around 1,000 people…

This was new for me and for everyone involved because it was the first time Civil Service Live was run as an online event. I co-presented a session called ‘Using analysis to provide insight and drive better decisions.’ Other presenter colleagues in this instance were from the Government Analysis Function, the Department for Transport and the Ministry of Housing, Communities and Local Government.

We provided delegates with insights into the broad range of areas where members of the Analysis Function are working to use their skills to inform policy design and delivery.

Insurance and reinsurance

Naturally, the webinar included discussions about the continuing adverse effects of the coronavirus pandemic. I emphasised GAD’s collaborative cross-government working to develop a policy response to the difficulties caused by COVID-19 in the trade credit insurance market.

I spoke about how GAD’s experts worked on this cross-government project to provide their knowledge of the insurance and reinsurance markets and their expertise in analytical modelling.

This collaborative approach meant we were able to develop a practical solution that addressed market shortcomings, resulting from the impact of the COVID-19 pandemic. At the same time, we helped ensure the policy solution provided value for money for the government with controls around the risks being accepted.

Better outcomes

The value of collaboration within and across Civil Service departments and professions was clear throughout the presentation. Working together we can produce more robust and resilient policy approaches that provide better value for money. And at GAD we are playing our role in that by building on our success of this summer’s webinars and planning a varied and interesting programme of online seminars over the rest of the year.

The opinions in this blog post are not intended to provide specific advice. For our full disclaimer, please see the About this blog page.

Recent Comments